Tucson Residential Recovery Fund

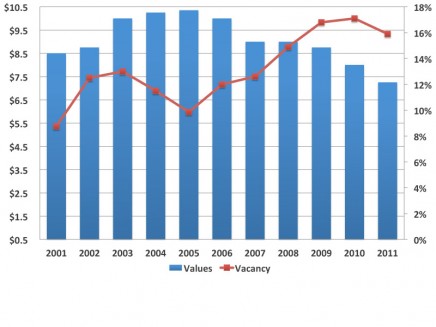

According to CNBC, Tucson is the emptiest city in the United States . With rental vacancies at 15.9 percent, Tucson is the seventh most vacant among major cities. The 6.8 percent homeowner vacancy rate was the highest in the country as of the second quarter of 2011.

Many properties are at risk or have gone back to the lender. Select properties are ideal candidates for acquisition, refurbishment and resale. These are the properties that we will target. We will be joined by Tyler Ford who has experience in the Tucson Residential Market.

Commercial Real Estate Recovery Fund(s)

The Tucson commercial real estate market has weathered the storm better than other areas. Speculative office space was not overbuilt to the extent of larger markets. Tucson has not seen the same rate of foreclosures and failed commercial properties that Phoenix has. Tucson has a moderate but stable economic foundation that will serve as a catalyst when the market returns. In the meantime, Tucson’s economic recovery is expected to be slow at best, as we move forward.

Our best opportunities for Commercial Property acquisitions will occur between mid-2012 and early 2015.

Commercial real estate – the last 10 years and looking beyond!

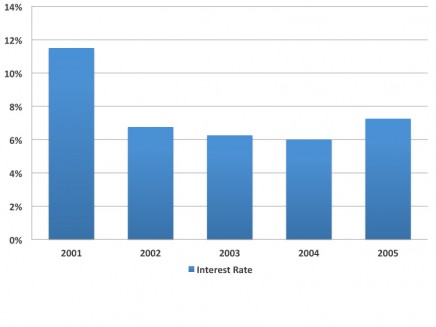

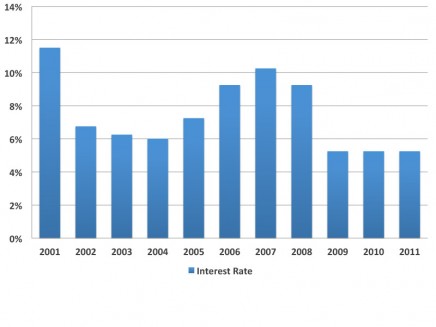

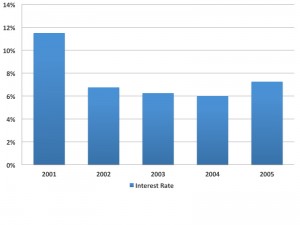

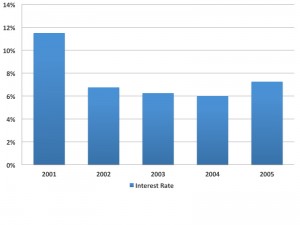

The Federal Reserve lowered interest rates in order to stimulate economic growth. The economy recovered and was booming by the mid-2000s. There were jobs. People were working and people were spending.

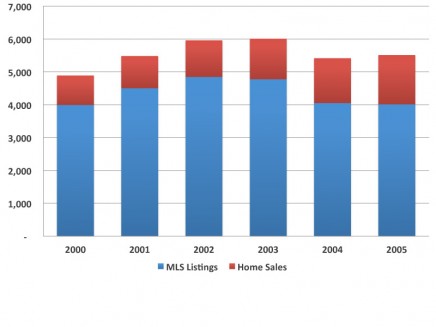

Interest Rates (2001 – 2005)

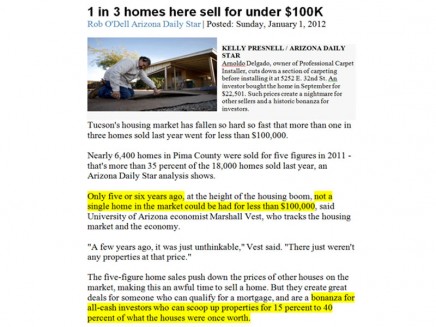

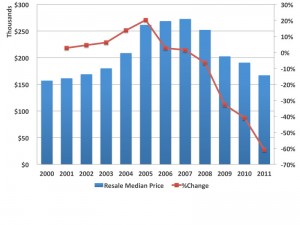

The combination of a healthy economy, low interest rates, easy credit, and the irrational beliefs of lenders and homeowners that home prices would continue to rise put a high demand on the housing market.

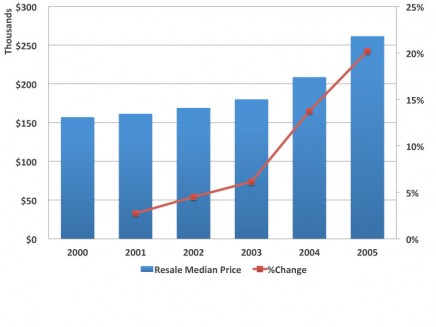

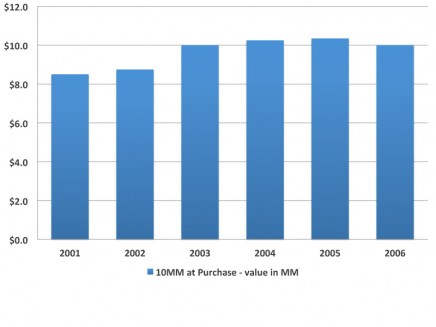

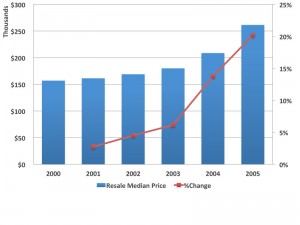

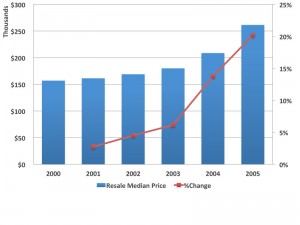

Home Values (2000 – 2005)

Prices of new homes and existing homes increased dramatically. The housing boom of 2002 – 2006 was unprecedented. For many a family their home became a “piggy bank” instead of their castle.

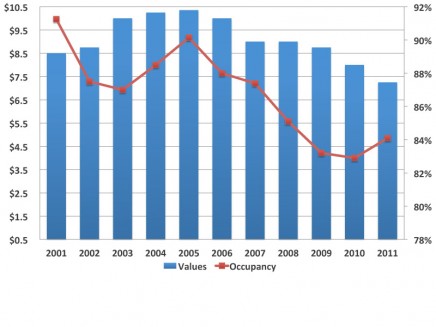

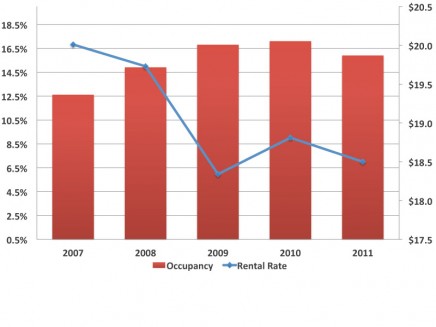

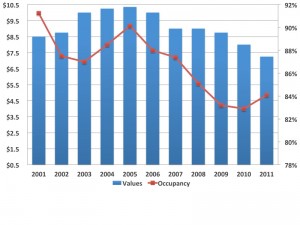

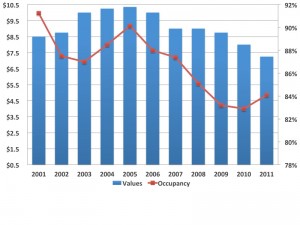

Commercial Occupancy (2001 – 2011)

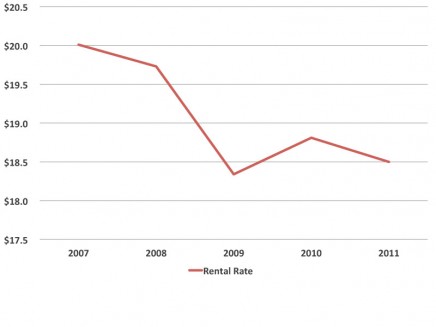

A healthy economy also creates demand for office, industrial and retail space. Commercial properties in the mid-2000s enjoyed high occupancy and were filled with tenants paying high rents. Investors were willing to pay more for income produced by Commercial Properties and values surged.

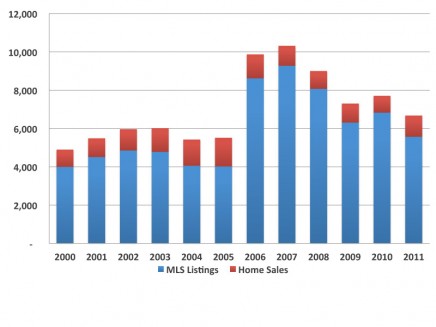

The residential housing market in the mid-2000’s was in a bubble. But bubbles eventually burst, and this one did in 2006. By October 2007, the U.S. Secretary of the Treasury called the situation “the most significant risk to our economy.” It created a destabilizing effect in all areas of the economy – a cascading effect of jobs being wiped out, incomes eliminated, mortgages in default and crippled lenders left with ‘toxic’ assets on their Balance Sheets.

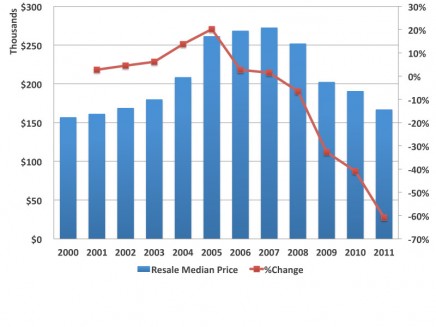

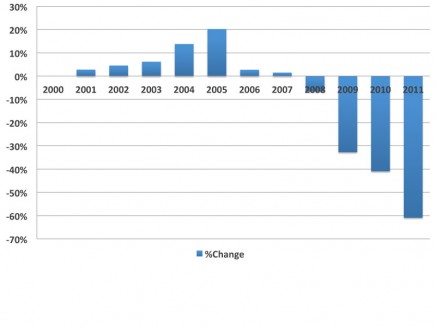

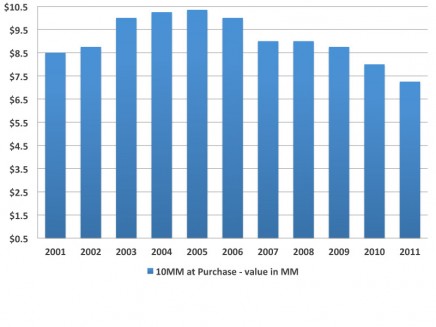

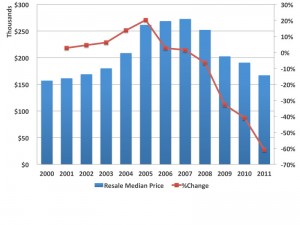

Home Values (2000 – 2011)

The commercial real estate market stayed strong for 18 months after the housing bust. By 2007, however, the economy’s decline (less jobs) had led to a decreased need for space. With the laws of supply and demand at work, vacancy rates soared and rents dropped.

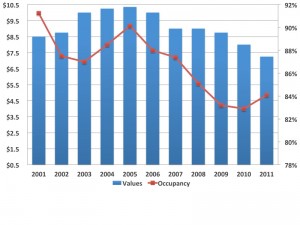

Commercial Occupancy (2001 – 2011)

This combination of increased vacancy and decreased rents significantly reduced commercial property values. It is estimated that commercial real estate has dropped 35-45% in value since 2006.

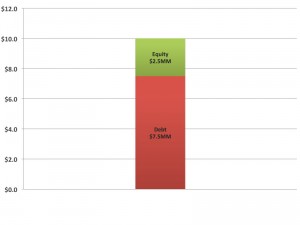

As the result of decreased commercial real estate values, some owners have been left in a difficult position. During the mid 2000s, Lenders were willing to provide loans as high as 75% loan-to-value ratios.

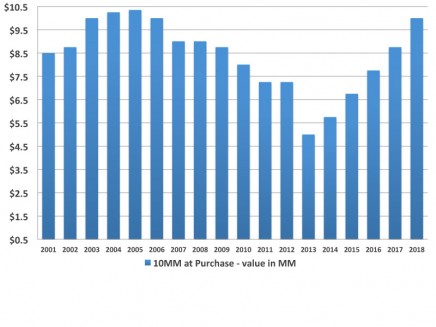

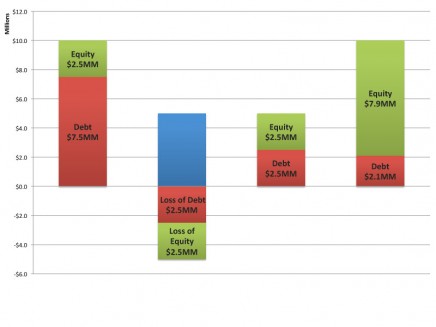

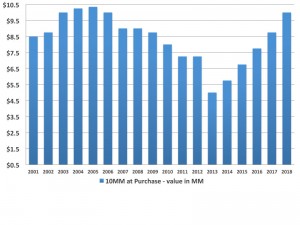

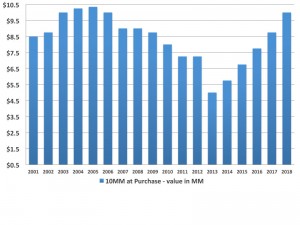

Let’s now imagine a property purchased in early 2003. The “Tale of the 10MM property”

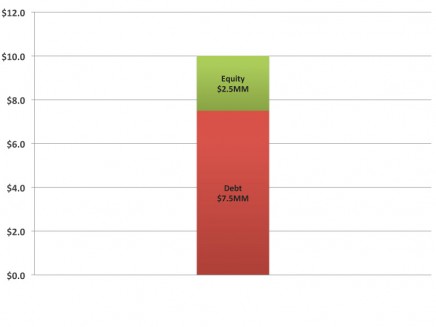

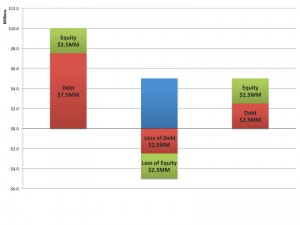

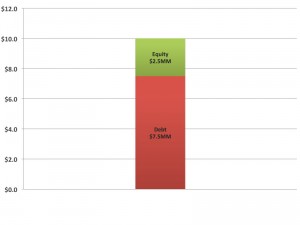

This property purchased by an investor group in 2003 was purchased for $10MM. The lender placed a $7.5MM loan on the property and $2.5MM was provided by the investors.

The Tale of the $10MM Commercial Property

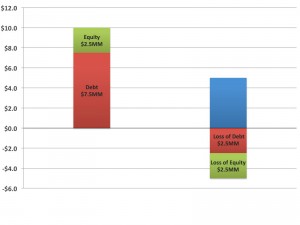

With rents and occupancy declining the owner finds it difficult to produce adequate cash flow to cover the mortgage payment.

In addition, the 25 year amortizing loan originated in 2003 has matured. In this case a 10 year stop.

The timing couldn’t be worse. Lenders look at the ability of a property to produce income in an amount to cover operating expenses and meet debt ratios. Properties with increased vacancy, decreased rent, decreased value and maturing debt will find it difficult to meet renewal standards and contemporary underwriting criteria in a tight credit market.

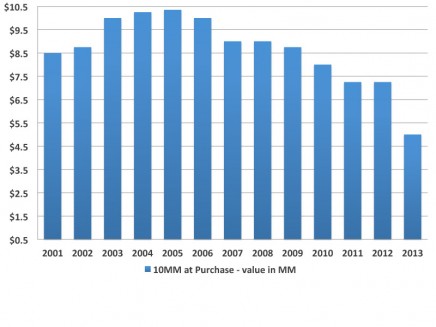

Based on the foregoing, it is reasonable to expect that these 10-year expiration periods will peak in 2013-2015. A tidal wave of distressed properties is expected to hit the market. These properties will provide investment opportunities for investors who are waiting and ready. The property in this example is no exception.

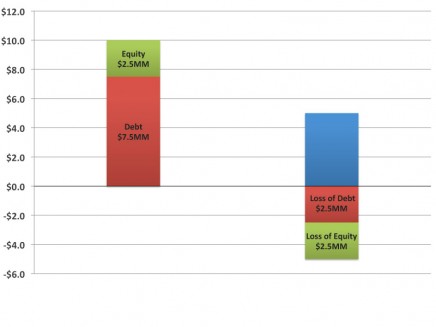

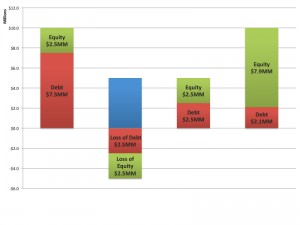

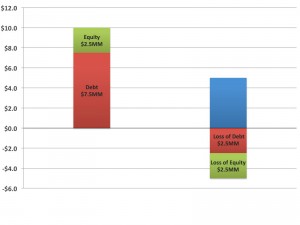

The Tale of the $10MM Commercial Property

The property worth 10MM in 2003 with debt of $7.5MM may be worth only $5MM in 2013 as the loan matures. The property owner with $2.5MM in equity in 2003 now has Zero equity remaining and the lender has a mortgage….. originally worth $7.5MM secured by a commercial building now worth only $5mm

The lender forecloses on the property and sells it to a new investor. The lender takes a loss of 33% and the previous owner loses his entire equity of $2.5MM

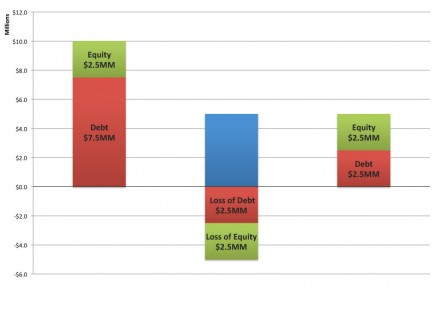

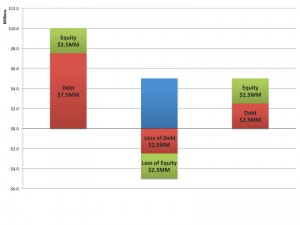

The Tale of the $10MM Commercial Property

The new owner invests $2.5MM and a new lender advances debt of $2.5MM for a total of $5MM. The new owner can afford to cure the deferred maintenance problems of the neglected property and seek tenants to fill the vacant spaces.

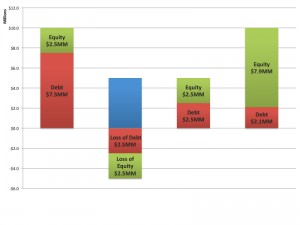

The new owner manages the property well and, if the economic condition of Tucson shall recover as we expect, the property will rise in value. By 2018 and based on our expectation of such economic recovery, the property value will increase and may even recover to the value of 2003. In that event, the new investors will be delighted with their periodic returns and the outlook for sale, and will stand to produce a return of 200% or more over the period of 5 years of ownership.

The Tale of the $10MM Commercial Property

The 10 Million property goes on and provides a place for others to do business and enjoys the care and attention it receives from the new and dedicated owner. Tenants and the Owner/ Investor are happy.

Commercial Values (2001 – 2011), Projected Values (2012 – 2018)

We will evaluate future opportunities with the intent of discovering properties that are well located that fit our criteria. When we find them well will let you know.

Let’s make the future prosperous.